In search of an industry primed for growth to start your next business? Look no further. Here are eight sectors where entrepreneurs can still get in early.

While breaking into any industry has its challenges, conditions in certain sectors make them ripe for new entrants. Here’s Inc.‘s annual look at the best industries for starting a business. The list is based on the latest data on today’s hot, burgeoning sectors and interviews with entrepreneurs, investors, and industry experts.

It’s still early days for these fields relative to more established sectors, but that’s part of what makes them attractive. Read on to see which U.S. industries could be home to tomorrow’s fastest-growing companies.

Drone manufacturing.

Estimated to be a $3.3 billion market in the U.S., the unmanned aerial vehicles (UAV) sector comprises companies that design and manufacture commercial, recreational, and military drones. The potential uses of commercial drones–humanitarian relief, scientific research, police surveillance, freight delivery–are virtually limitless.

Why it’s hot: If the Federal Aviation Administration loosens regulations for the use of commercial drones, the sector could help produce as many as 100,000 new U.S. jobs by 2025, according to a report from the Association for Unmanned Vehicle Systems International.

Skills needed: Startups will need IT workers with the skills related to building, piloting, and monitoring drones. Companies should also be prepared to adapt quickly to technological changes and frequently upgrade their products.

Barriers to entry: The capital investment for both research and development and the manufacturing of drones is high. New entrants will also have to patent their own products to gain a competitive advantage.

The downside: Though FAA regulations are expected to be finalized this year, the wait for them will delay demand for commercial drones.

Competition: A large number of industry players make competition high in this industry. Meanwhile, as U.S. companies wait for final regulations to become law, competitors outside the U.S. not contending with regulations can gain an advantage in the commercial and recreational drone market. China’s SZ DJI Technology Co. is already the largest consumer drone company in the world.

Growth: The industry is estimated to have grown 6.2 percent in the U.S. in 2015 and is expected to grow at an average rate of 5.8 percent annually, to $4.34 billion, by 2020.

Virtual reality.

Industry experts agree that 2016 will be a breakout year for virtual reality. Consumers are expected to purchase several million VR headsets in 2016. These will be pricey models–estimates do not include Google Cardboard and other low-cost head-mounted displays that work with smartphones. For example, Facebook’s Oculus Rift headset carries a price tag of $699. While the gaming industry is likely to be the initial driver for widespread use of VR, digital entertainment ranging from movies to live events will follow, as will content related to education and training in sectors like health care and the military, according to venture capital and private equity research firm PitchBook.

Why it’s hot: As of November, virtual reality companies had raised about $630 million in funding worldwide across 120 deals in 2015, up from just $70 million and 13 deals in 2010, according to PitchBook. Facebook’s $2 billion purchase of VR hardware, software, and content company Oculus in 2014 also helped fuel predictions that VR will be the next major technological breakthrough after mobile.

Skills needed: New entrants in the virtual reality sector will need to be able to shoot and produce VR video content, host live streams of video experiences, and develop software for mobile-based VR.

Barriers to entry: VR continues to be an up-and-coming technology, making research and development a significant potential cost.

The downside: There are doubts surrounding whether VR will deliver real-enough experiences, and it’s unclear when, if ever, head-mounted displays will become a mass-market product. High-end headsets that sell for several hundred dollars also pose a challenge for broad consumer appeal.

Competition: It’s still early days for determining the level of competition, but about 60 companies are currently developing products in one or more of VR’s three verticals: hardware, software, and content. In addition to Facebook’s Oculus, companies working across all three include Jaunt, Magic Leap, and NextVR. Some of the industry’s largest companies making hardware are HTC, Samsung, and Sony.

Growth: The value of the global virtual reality hardware market could be as high as $62 billion by 2025, according to investment bank Piper Jaffray. The global VR software market, meanwhile, could reach $5.4 billion by that year. Financial services company UBS has also estimated that annual device sales will reach more than 34 million units worldwide by 2020.

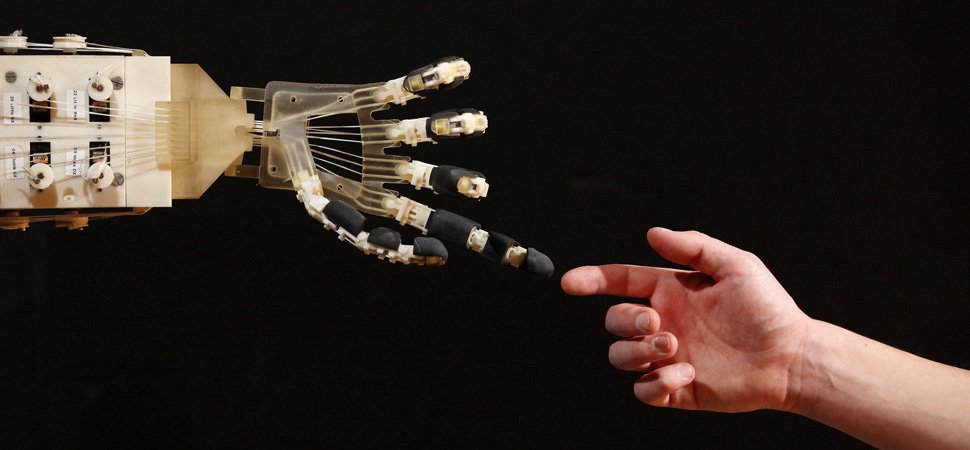

Artificial intelligence.

More than a single industry, artificial intelligence is a technology likely to disrupt a wide variety of sectors. While self-driving cars are expected to have a significant impact on auto safety, AI and machine learning will make small tasks, such as planning vacations and booking meetings, even easier.

Why it’s hot: The use of AI techniques and systems is expected to grow dramatically in the near future, with business intelligence companies likely to be one of the largest sectors adopting the technology. Venture capitalists invested $309 million in U.S. artificial intelligence startups in 2014, up more than 20-fold from 2010, according to venture capital research firm CB Insights.

Skills needed: AI startups require individuals with advanced computing skills and specific degrees focused on the technology.

Barriers to entry: Startups in this industry require highly skilled specialists, most of whom are frequently hired by large companies working on advanced projects for AI, like self-driving car technology. Gathering the necessary data to build required algorithms is also a major challenge.

The downside: Because AI is still an emerging technology, it’s too early to say which specific fields it will benefit the most. Entrepreneurs including SpaceX founder Elon Musk and Apple co-founder Steve Wozniak also have expressed concern over the potential dangers of AI, such as integrating the technology with weaponry.

Competition: The number of new AI startups in the U.S. raising venture capital rose from just two in 2010 to 16 in 2014, according to CB Insights. Examples of major companies with AI products range from Apple’s Siri and Microsoft’s Cortana to industrial robots company Rethink Robotics, which raised more than $113 million in funding in 2015.

Growth: The global market for AI technologies in the U.S. is expected to reach $9.2 billion by 2019, a 100 percent increase over 2014, according to market intelligence company IDC. Meanwhile, market research firm BCC Research predicts that the global market for smart machines will grow roughly 20 percent per year, reaching $15.3 billion by 2019.

Food analytics and tech.

The food tech industry typically refers to companies that use internet or mobile technology to make the preparation, assembly, or distribution of food products more efficient or profitable. One of the emerging areas of the sector is food analytics, which includes companies developing smart kitchen appliances such as devices that help consumers with food inventory management. Food tech has been dominated by U.S. companies during the past few years, but funding of companies outside the U.S.–particularly in India and China–exploded in 2015.

Why it’s hot: Global investment in food tech companies reached $5.74 billion across 275 venture capital deals in 2015, up from $2.28 billion and 162 deals in 2014, according to CB Insights.

Skills needed: Startups in this space will need strong Web software development and other IT skills, plus experience in food services and logistics for companies operating within the food delivery space.

Barriers to entry: Some segments of the food tech industry are already crowded with startups, and the emerging nature of food analytics will require new entrants to invest a significant amount in research and development.

The downside: Food analytics is still in its infancy compared with other segments of food tech, and smart kitchen devices remain a largely untested product with consumers.

Competition: Nearly 90 U.S. companies offer some form of online food delivery, according to consulting firm Rosenheim Advisors. Early-stage food tech companies with venture backing include prepared meal delivery company Maple, online farmer’s market Farmigo, and food service accounts payable software company Sourcery.

Growth: U.S. food and beverage e-commerce sales are expected to experience 17 percent average growth per year during the five-year period ending in 2016, reaching $9.4 billion, according to market research firm eMarketer. Food and beverage is also the largest retail category in the U.S., generating $600 billion a year in sales.

Biometric scanning software.

Estimated to be a $4.9 billion market in the U.S., the biometric scanning software industry is composed of companies that develop software that powers eye, fingerprint, and facial recognition systems. Demand for biometric scan software is expected to accelerate during the next five years, driven in part by stronger investment from private enterprises.

Why it’s hot: Development of software that powers eye, fingerprint, and facial recognition systems is speeding up in both the government and the private sectors. Private industries expected to drive widespread demand for the technology include health care, as hospitals move to retrieve patient records through a single biometric scan, and construction, with buildings using fingerprint scanning for identity verification. Government agencies responsible for border control and immigration are also expected to adopt the technology.

Skills needed: Startups will need highly skilled programmers and scientists who can develop biometric software, and should have employees with experience in statistical analysis and building user-friendly products.

Barriers to entry: The highly skilled labor required to build biometric scanning software can be expensive and major players tend also to manufacture complementary hardware, which helps bolster their dominance in the sector.

The downside: While fingerprint recognition software is the dominant technology in this sector, it’s unclear whether retinal recognition, 3-D facial recognition, or another type of authentication will emerge as the preferred method. This could present a danger for startups that invest significantly in a specific technology that is ultimately not embraced by the private or public sectors.

Competition: Major players include the 3M Company, with about 13 percent U.S. market share, and Safran Group, with about 8 percent U.S. market share, according to research firm IBISWorld. Apple also integrates its AuthenTec technology into many of its products, giving the company a significant share of the mobile market.

Growth: The industry is estimated to have grown 6.2 percent in 2015, and is expected to grow at an average rate of 14 percent annually, to $9.47 billion, by 2020, according to IBISWorld.

Fraud detection software.

Estimated to be a $1 billion market in the U.S., this industry includes businesses that develop software to detect and protect against fraudulent payments. With both fraudulent activity and the number of platforms on which it takes place increasing, the market for fraud detection software developers is expected to continue to grow.

Why it’s hot: The fraud detection software sector is in the growth stage of its life cycle and is expected to see rising demand from small and midsize businesses. As more industries adopt mobile-based payment and commerce systems–and more consumers and businesses embrace the cloud–new opportunities for criminals will drive more demand for fraud detection software.

Skills needed: Startups in this space will need strong Web software development skills and IT professionals who can stay current on security compliance laws and emerging software trends, such as new coding platforms.

Barriers to entry: New entrants will have to invest in powerful computer and networking technology and contend with the consolidation already occurring among existing players. Attracting top developer talent is also a costly barrier to entry.

The downside: Because fraudsters are constantly changing their methods to outsmart detection systems, new entrants must continuously improve their offerings to keep up with increasingly sophisticated tactics.

Competition: There is no clear leader in the fraud detection software industry, as industry consolidation has yet to establish a single, dominant player. Major companies include San Jose, California-based Fair Isaac Corporation American, a software company focused on the financial services sector, and Cary, North Carolina-based SAS Institute, whose flagship product is used in business intelligence and predictive analytics.

Growth: The industry is estimated to have grown 22 percent in 2015 in the U.S., and is expected to grow at an average rate of 12.4 percent annually, to $1.78 billion, by 2020, according to IBISWorld.

Corporate wellness.

Estimated to be a $7.2 billion market, the U.S. corporate wellness industry comprises companies that provide workplace programs designed to support healthy behavior. Each dollar U.S. business owners invest in disease-management services, a subset of corporate wellness, is estimated to return $3.80 in savings, productivity improvements, and other benefits, according to a report by the Rand Corporation.

Why it’s hot: With businesses looking for ways to lower health care costs, corporate wellness programs are expected to boom between now and 2020.

Skills needed: Startups in corporate wellness will need to be able to design effective programs to help users with everything from stress management to quitting smoking, and will need software-development skills to make wellness programs convenient and accessible.

Barriers to entry: New entrants frequently have to hire nutritionists, physical trainers, and other workers to perform screenings and analyze data. Pay for employees with the necessary certifications and specialized training also can be high.

The downside: Nearly one-third of U.S. employers that offer wellness programs have employee participation rates of 20 percent or lower, according to IBISWorld.

Competition: There is a moderate level of competition in the sector. Major players include Chicago-based ComPsych Corp., one of the largest providers of employee assistance programs, and UnitedHealth Group’s wellness division, OptumHealth.

Growth: The industry is estimated to have grown 6.3 percent in the U.S. in 2015, and is expected to grow at an average rate of 7.8 percent annually, to $10.5 billion, by 2020, according to IBISWorld.

Sustainable building materials.

Estimated to be a $36 billion market in the U.S., the sustainable building materials sector manufactures renewable products for all types of buildings–not just so-called “green” buildings. The materials help reduce use of water, energy, and other resources and are more efficient than traditional products for the way they reduce pollution and waste.

Why it’s hot: An uptick in U.S. construction activity and growing consumer interest in sustainable and energy-efficient products will combine to fuel growth, as will government incentive programs.

Skills needed: Startups will need deep knowledge of architectural design and green building construction, and should be able to manufacture a diverse range of products that meet the needs of different customers.

Barriers to entry: New entrants will have to develop the required technologies and processes to produce sustainable materials. This can involve research and development on energy-efficient products and purchasing specialized machinery.

The downside: This sector is sensitive to broad U.S. economic health trends, which can have a heavy impact on the construction industry’s activity and home remodeling spending.

Competition: Large companies include Lancaster, Pennsylvania-based Armstrong World Industries, which manufactures sustainable building materials that meet the Leadership in Energy and Environmental Design (LEED) requirements, and West Trenton, New Jersey-based Homasote Company, which manufactures building products made from recycled materials.

Growth: The industry is estimated to have grown 11.8 percent in 2015, and is expected to grow at an average rate of 10.6 percent annually, to $59.79 billion, by 2020, according to IBISWorld.